eBay Stock: Is EBAY Outperforming the Consumer Discretionary Sector?

/EBay%20Inc_%20logo%20by-%20JHVEPhoto%20via%20iStock.jpg)

Valued at a market cap of $41.5 billion, eBay Inc. (EBAY) is a global e-commerce company that operates one of the world’s largest online marketplaces. Founded in 1995 and headquartered in San Jose, California, eBay connects millions of buyers and sellers across more than 190 markets worldwide.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and eBay fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the internet retail industry. eBay is well known for its auction-style listings but also supports fixed-price “Buy It Now” sales, which have become the dominant transaction method on its platform.

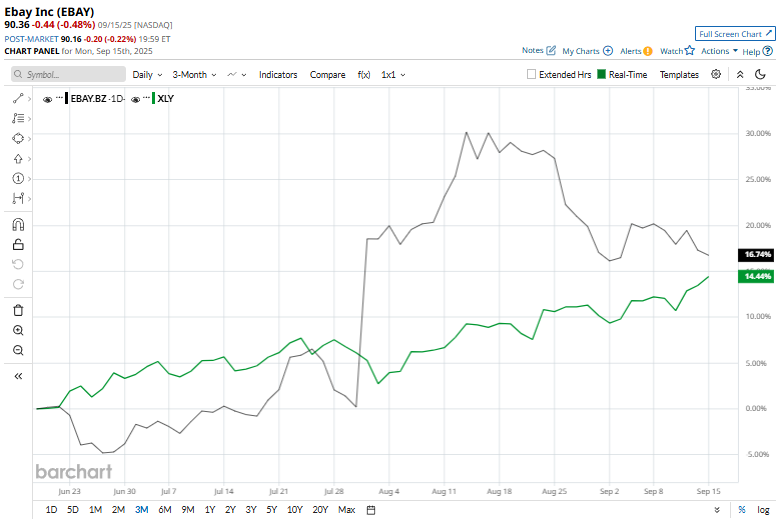

This e-commerce giant is currently trading 10.7% below its 52-week high of $101.15, reached on Aug. 15. EBAY has rallied 16.8% over the past three months, surpassing the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 13.7% gain over the same time frame.

In the longer term, EBAY has surged 42.4% over the past 52 weeks, significantly outperforming XLY’s 25.1% rise over the same time frame. Moreover, on a YTD basis, shares of EBAY are up 45.9%, compared to XLY’s 7.3% rally.

To confirm its bullish trend, eBay has been trading mostly above its 50-day and 200-day moving averages over the past year, with some fluctuations.

On July 30, eBay shares surged 18.3% after the company posted stronger-than-expected Q2 2025 results. Adjusted earnings came in at $1.37 per share on revenue of $2.7 billion, both ahead of forecasts, fuelled by robust demand in collectibles and Pokémon cards. Looking ahead, eBay projected Q3 revenue in the range of $2.69 billion to $2.74 billion, above Street estimates.

However, EBAY has outpaced its key rival, MercadoLibre, Inc. (MELI), which gained 10.1% over the past 52 weeks and 37.4% on a YTD basis.

The stock has a consensus rating of "Moderate Buy” from the 32 analysts covering it, and the stock currently trades above its mean price target of $89.69.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.